Recent Events

Last week Silicon Valley Bank (SIVB) was closed by the California Department of Financial Protection and Innovation, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. The FDIC took steps over the weekend to protect both insured and uninsured depositors, and the Federal Reserve (Fed) established a new Bank Term Funding Program, through which any US depository institution can obtain financing for eligible collateral at full par value for up to one year. While these actions quelled speculation about the event’s outcome and provided a safety net for the bank’s depositors, large questions remain about whether enough has been done to address deposit flight from other institutions and whether there is now more systemic contagion.

Although SIVB’s closure was an unexpected tail event, as of this writing most agree it is not a credit event where poor asset quality caused the issues (as with highly levered, poor-quality mortgage-backed securities in 2008, or during the savings and loans crisis of the 80s). SIVB had deposits that were heavily skewed toward its large venture capital and private equity clients, whereas its assets were invested in longer-dated fixed rate assets. As interest rates rose rapidly, the bank’s funding costs increased while its longer-dated assets experienced price declines due to large duration risks. As asset prices fell, the bank felt compelled to sell part of its portfolio – thus incurring realized losses – to raise capital to fund its business.

Macroeconomic View

Prior to the SIVB-related events, 2023 started with a very positive tone in January. We believe rising optimism was driven by a combination of factors, including the market’s perception that interest rate hikes were mostly done, that the Fed had engineered a soft landing and was on the road to curbing inflation, and models shifting to favor more fixed income and yield. Since February, and prior to the events of last week, inflation had remained sticky and the Fed had shifted its tone to reflect smaller, but more possible, rate hikes. While market sentiment changed to a more cautious stance, over the last few trading days (since the SIVB-related news emerged), interest rates have declined dramatically as seen below in the graph which compares US Treasury yields across tenors between March 6 and March 13.

Figure 1: US Treasury Yields by Tenor – Current (3/13/23) vs. 1 Week Prior (3/6/23)

Source: Bloomberg. As of: March 13, 2023. The US Treasury Actives Curve – also known as a yield curve – depicts the yield of Treasury securities of various maturities at a point in time.

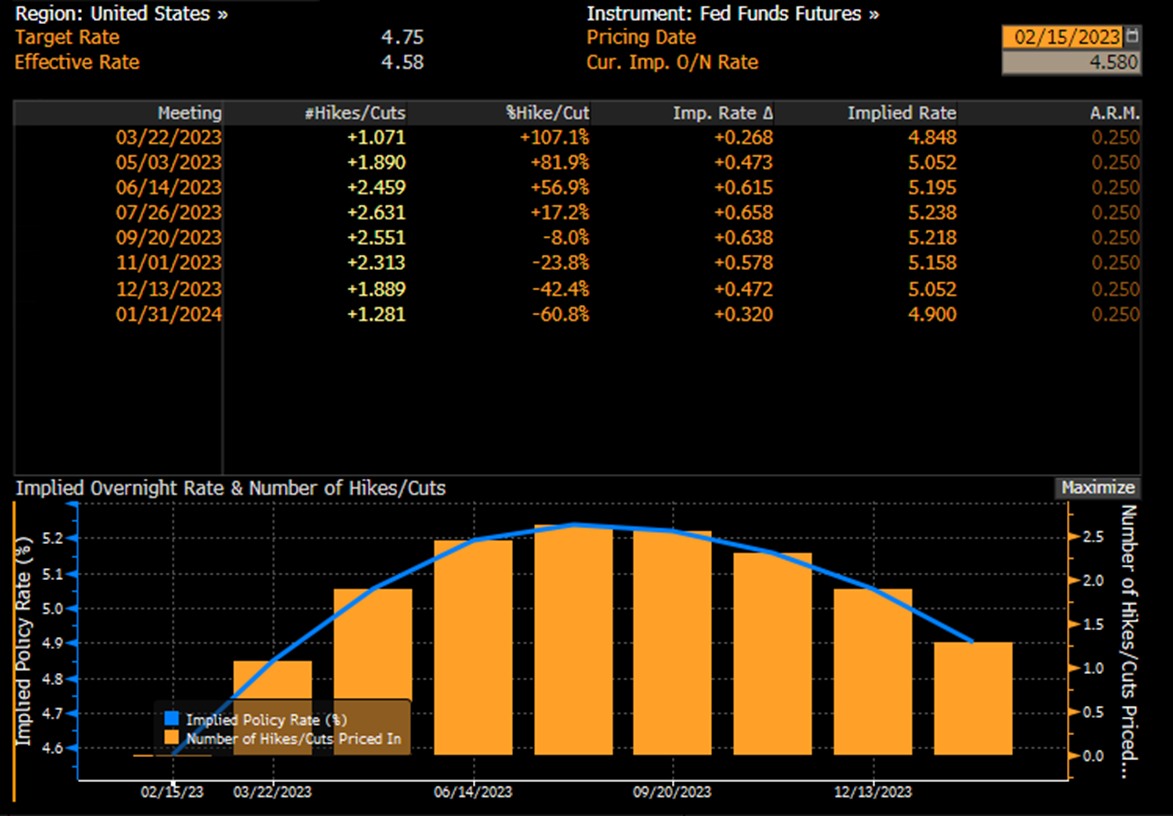

In addition, market stress is causing economists to now forecast that the Fed, despite being in the midst of a difficult fight to curb inflation, will pause rate hikes and may even cut rates during 2023. While we do not know the certainty of these actions or the impact that SIVB could have on banks and consumers, we can clearly see below the changes between forecasts for rate hikes from mid-February (Figure 2) to the present (Figure 3).

Figure 2: Implied Federal Funds Rate Projections – 2/15/23

Source: Bloomberg. As of: February 15, 2023.

Figure 3: Implied Federal Funds Rate Projections – 3/14/23

Source: Bloomberg. As of: March 14, 2023.

Over the last 18 months, inflation expectations have shifted along with economic data and Fed priorities. After trending downward since March 2022, expectations began to rise once again beginning in January 2023, only to be reduced again with the fallout from this past week’s events.

Figure 4: 5-Year Inflation Expectations

Source: Bloomberg. As of: March 13, 2023. The 5-Year Breakeven Inflation Rate (USGGBE05 Index) is a representation of expectations for inflation five years into the future, derived from 5-Year Treasury constant maturity securities and 5-Year Treasury inflation-indexed constant maturity securities.

Water Island Credit Opportunities Fund – Portfolio Commentary

Over the first two months of 2023, two big factors have been the primary drivers of performance. First, many of the transactions behind our merger-related positions are in the process of closing or have closed. These are situations where target company bonds or loans are expected to be retired as part of the transaction. Annualized yields on these positions have been in the range of 6%-8%. We have not been impacted by any broken deals, and when we invest in mergers we typically seek to limit downside to 20 basis points of risk based on our estimates, using hedges where possible, and avoid controversial deals unless downside is minimal.

Second, investments predicated on companies refinancing debt prior to its stated maturity have been positive contributors. As capital markets reopened in January, these companies were able to place new debt in the market and used proceeds to retire debt and extend maturities. Several of our positions were first lien bonds, and the news of their refinancing led to gains in their bond prices. We think this trend will continue throughout the year as management teams are looking to take advantage of more stable markets, and corporations are also looking to proactively extend their maturity profiles in response to interest rate uncertainty.

Given this trend, we are building positions of what we believe to be solid-performing credits, with maturities less than three years, and secured status where available. We are also using equity and options to seek to mitigate downside. We expect to see approximately 30% of the portfolio roll over during Q1 as deals close, which could benefit the fund during a volatile time as the prices of bonds involved in concluding catalysts trade to par or to their deal price. We have several potential catalysts on our radar, and we further anticipate many of these to result in the announcements of definitive merger deals which can replenish this portion of the portfolio. Overall, we are positive on our view for corporate catalysts, encouraged by more attractive yields, and eager to capitalize on these opportunities as we seek to deliver our clients attractive risk-adjusted returns – though we are cognizant of the need to remain extremely vigilant when investing following events like those experienced over the last week. In the short-term, we expect equity and rate market volatility to become elevated and for credit spreads to widen, but we ultimately believe that corporate management teams will continue to seek strategic alternatives whether they be mergers, spin-offs, assets sales, or refinancings – all events that are key to our strategy.

GLOSSARY: A basis point is an amount equal to 1/100 of 1%. A credit spread is the difference in yield between a US Treasury security and a debt security with the same maturity but of lesser quality. Duration is the approximate percentage change in a bond’s price that will result from a 1% change in its yield. A first lien bond is debt that is secured by collateral, the holders of which are paid back before all other debt holders. Maturity profile refers to the overall view of a company’s issued debt by year of maturity. The par value, or face value, of a bond is the amount of money that an issuer promises to repay bondholders at the maturity date of the bond. Secured debt is debt that is backed by collateral. Tenor refers to the length of time remaining on a financial contract before its expiration or maturity.

Commentary represents the manager’s current opinion and may contain certain forward-looking statements. Actual future results may differ from our expectations. Our views may change at any time, and we have no obligation to update them. Commentary should not be regarded as investment advice or a recommendation of any security or strategy. Investing involves risk, including loss of principal. Past performance is not indicative of future results.

RISKS: Investments are subject to risk, including possible loss of principal. There can be no assurance that the fund will achieve its investment objectives. The fund uses investment techniques and strategies with risks that are different from the risks ordinarily associated with credit investments. Such risks include event-driven risk; merger arbitrage risk (in that the proposed reorganizations in which the fund invests may be renegotiated or terminated, in which case the fund may realize losses); active management risk; credit risk; convertible security risk; liquidity risk; market risk; sector risk; interest rate risk; short sale risk; hedging transaction risk; large shareholder transaction risk; leverage risk; high portfolio turnover risk (which may increase the fund’s brokerage costs, which would reduce performance); counterparty risk; temporary investment/cash management risk; swap risk; options risk; preferred security risk; investment company and ETF risk; derivatives risk; LIBOR rate risk; currency risk; and foreign securities risk. Risks may increase volatility, increase costs, and lower performance.